M-Pesa Blends Fintech + Mobile in Kenya

29 Dec 2016I rarely go to the bank nowadays.

~Taxi driver in Nairobi, Kenya speaking to

a 60 Minutes reporter about M-Pesa

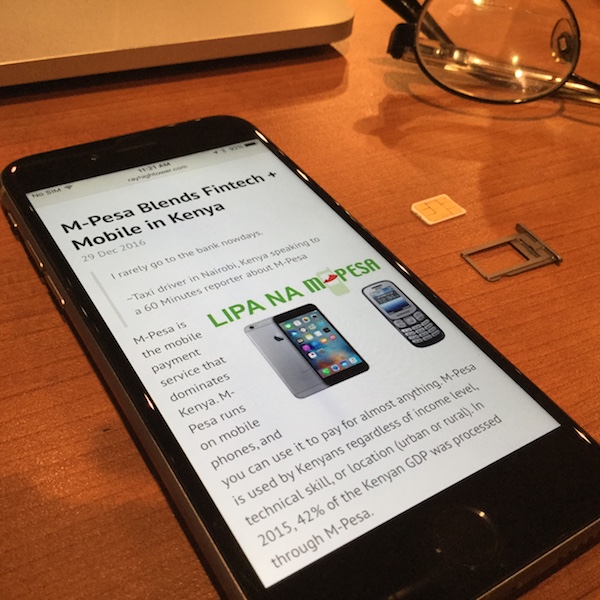

M-Pesa is the mobile payment service that dominates Kenya. M-Pesa runs on mobile phones, and you can use it to pay for almost anything. M-Pesa is used by Kenyans regardless of income level, technical skill, or location (urban or rural). In 2015, 42% of the Kenyan GDP was processed through M-Pesa.

M-Pesa is the mobile payment service that dominates Kenya. M-Pesa runs on mobile phones, and you can use it to pay for almost anything. M-Pesa is used by Kenyans regardless of income level, technical skill, or location (urban or rural). In 2015, 42% of the Kenyan GDP was processed through M-Pesa.

“Pesa” is the Swahili word for money, and the “M” stands for mobile. “Lipa na M-Pesa” means “purchase with M-Pesa”. My first M-Pesa experience happened during RubyConf Kenya in May 2016. So many developers at the conference raved about the service that I had to try it.

Running on the SIM Card

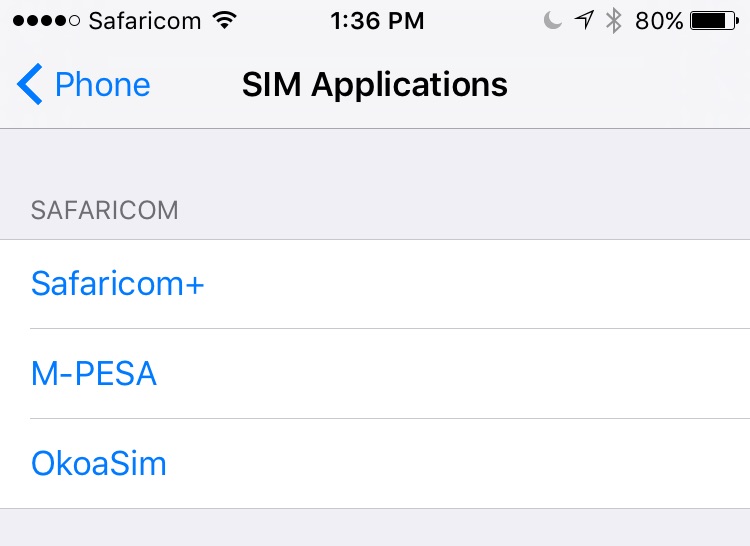

M-Pesa runs on a mobile phone’s SIM card. Therefore the app can run on any mobile phone, from the latest smartphone to the oldest feature phone. To run the app on my iPhone 6, I followed these steps:

- Signed up for the Safaricom service.

- Swapped my existing SIM for one for Safaricom.

- Added some money to my new Safaricom account.

…and I was ready to start using M-Pesa.

First Purchase

On a feature phone, M-Pesa appears on the menu with all of the other apps on the SIM card.

On a feature phone, M-Pesa appears on the menu with all of the other apps on the SIM card.

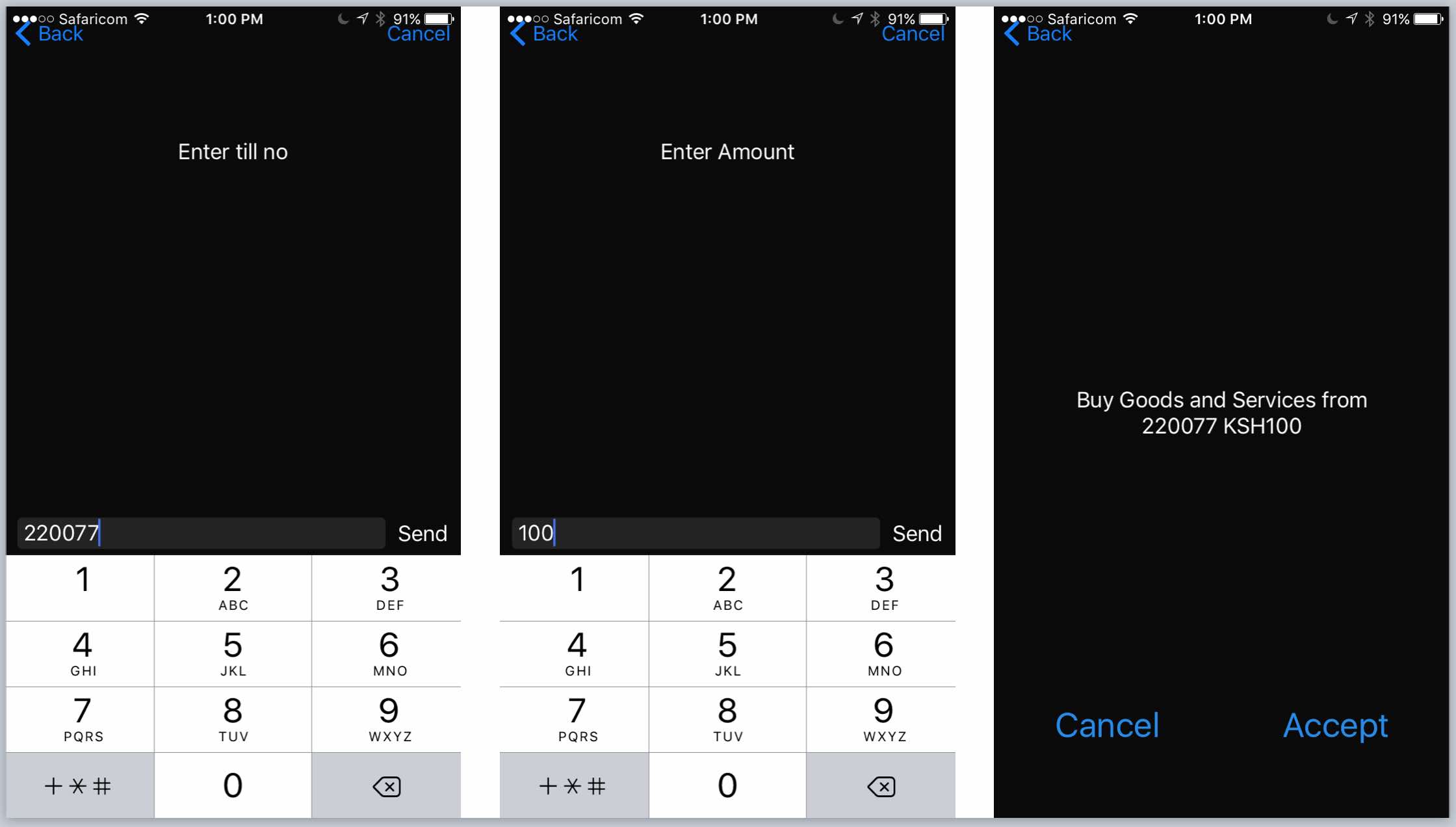

On a smartphone, using M-Pesa requires navigating to “SIM Applications” and finding the M-Pesa app. If a business accepts M-Pesa for payment, they will have a till number. Enter the till number into the M-Pesa, enter the amount you owe, confirm the transaction, and you’re done. It’s that simple.

Payments are sent between individuals just as easily. Sharing a cab? Each party can send their share to the driver via M-Pesa.

The Future of M-Pesa

The future looks bright any time young people with technical skills get excited about an idea. While in Kenya, I met several software developers who are building apps and businesses on top of the M-Pesa payment system. Way to jump on an opportunity! The M-Pesa ecosystem is a cool blend of financial technology, mobile communications, and user experience. We know the UX is solid because everyone in Kenya uses M-Pesa.

M-Pesa vs Bitcoin

A comparison between M-Pesa and Bitcoin might seem “apples-to-oranges” to those with deep blockchain knowledge. But the comparison has value because:

-

Both are methods of payment that avoid paper currency.

-

Both have the potential to disrupt the banking system.

Having used both M-Pesa and Bitcoin, here’s my assessment.

-

M-Pesa has expanded quickly because it’s easy to use and it’s available on the one device that everybody uses, the mobile phone.

-

Bitcoin is less accessible because a user must open an account with a third-party service (like Coinbase or a wallet) to begin acquiring or spending the currency. In other words, the user must really want to use Bitcoin in order to get started.

-

M-Pesa is like the impulse items near the checkout line at the grocery store. It’s easy to start using M-Pesa because it’s right at your fingertips.

-

Bitcoin is somewhere in the back of the grocery store. You can get it, but you must look for it.

Bitcoin is still in the “early adopter” stage of Clayton Christensen’s technology adoption framework. Early adopters are willing to put up with a few headaches or obstacles. But the masses of people want something easy to use. That’s where M-Pesa fits the bill.

Feel free to express yourself in the comments if you disagree :-)

Fintech Excitement

Any time we have a product used by so many people, from such a diverse set of backgrounds, network effects come into play. Safaricom is in an excellent position to benefit from the network they’ve built. Somewhere, maybe sometime soon, a smart group of developers will build on top of the M-Pesa platform and benefit, too.

What an exciting time to be in fintech!