IIREC 2020 - Recap

27 Jan 2020

One reason to attend conferences: To discover trends while we still have time to be on the cutting edge. Over 400 trend-spotters gathered in downtown Los Angeles for this weekend’s Intelligent Investors Real Estate Conference. This post offers a snap-shot of the event.

Event Summary

IIREC2020 was an amazing collection of investors and service providers, coming together to learn and to teach. Beyond the learning, a few people that I chatted up during the hallway track (see below) shared their approach to problems that real estate investors are uniquely posistioned to attack.

Every attendee was exposed to tools that we can use to deliver better value for our stakeholders: Investors, residents, tenants, service providers… every stakeholder wins.

Where are Investors Investing?

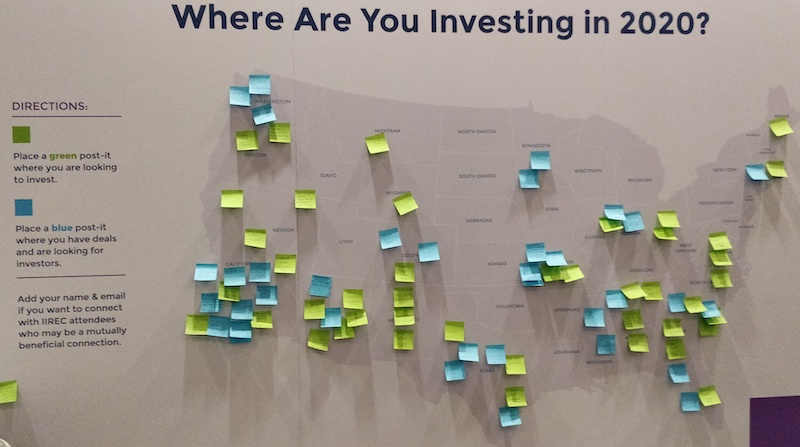

Where are investors investing? Two ways to answer that question: By geography, and by asset class. The IIREC organizers gathered informal data via a wall-sized map and a stack of sticky notes, seen below.

Geographically, IIREC attendees appear to be focused in the Southern US and on the Atlantic and Pacific coasts. The southern trend fits with my intuition, but strong interest in the coasts surprised me. My conversations with other real estate investors have led me to believe that money is moving away from the coasts due to the high cost of entering deals.

Lesson learned: It’s important to offset intuition with data.

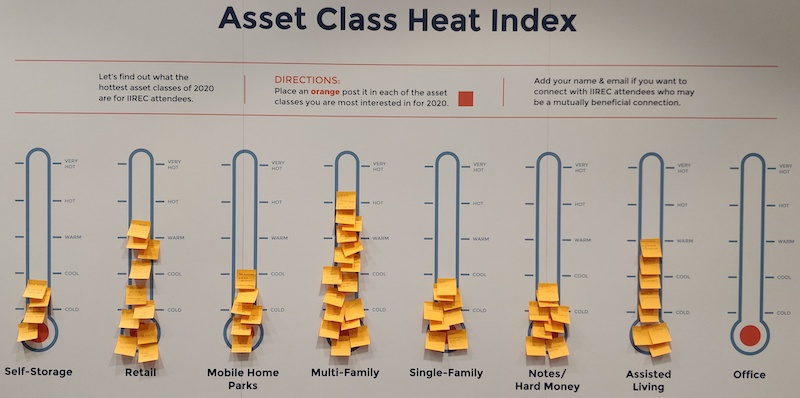

What about asset classes? From the chart below, more investors are focused on multi-family than any other asset class. Office deals appear to be less attractive.

Rich Panels & Presentations

Presentations from REI industry leaders were rich with learning and insight. Here are a few snippets.

-

Macroeconomics: No investor invests in a vacuum. Millennials are less inclined to purchase single family homes because they have high college debt and they prefer the experience of travel vs putting down roots. Therefore, investments in multifamily rentals are likely to do well.

-

Retail Apocalypse: Retail investors fear Amazon (rightly so). Fear reduces competition, and therefore opportunities are surfacing. Grocer-anchored retail centers are a favorite.

-

Opportunity Zones: OZs offer another way to shield capital gains while helping to stimulate values in OZ areas.

-

Charts. If you need to make a decision and the data is available, make a chart. Charts give us clarity. This approach has served Bob Norris for decades.

-

Recession-Resistant RE: Tough to find when Wall Street and the large private equity firms compete for assets by over-paying. It’s great to sell to them, but what do you do next?

Hallway Track

Beyond presentations and panels, much of the learning at IIREC happened in between the scheduled sessions. Conversations with other professionals can encourage us to think about challenges in bold new ways. For example…

- More than one attendee told me about their plans to attack homelessness with manufactured housing. And it’s not just about having a place to live. Some owners are providing job training and career counseling on-site.

- Multiple large-scale owners have properties dedicated to former prisoners. Once a person has paid their debt to society, it’s helpful for those on the outside to provide means for re-entry into society. Otherwise, recidivism rates soar.

- Properties dedicated to newly emancipated foster youth. What happens to a foster child when they reach the age of eighteen? They’re aged out of the system. Humans crave community support. If positive support is not forthcoming, an 18-year-old might fall in with people who are less-than-helpful to society.

Smart multi-family investors are not just providing shelter. They’re offering services that ideal residents find valuable: adult literacy, after-school programs for kids. In many cases, business leaders can solve problems faster and more effectively than governments. The best capitalists are service-oriented, too!

Conclusion

My conference calendar consists mainly of tech-focused events where I’ve built a solid network over the years. IIREC was interesting because I didn’t know any of the other attendees prior to the conference. Launching Bridgetown Partners has given me an opportunity to expand my service to others through my professional network. Let the connecting begin.

To the IIREC2020 organizers: Thank you for creating a powerful event!