Artificial Intelligence and Commercial Real Estate

06 Dec 2022Introducting ChatGPT

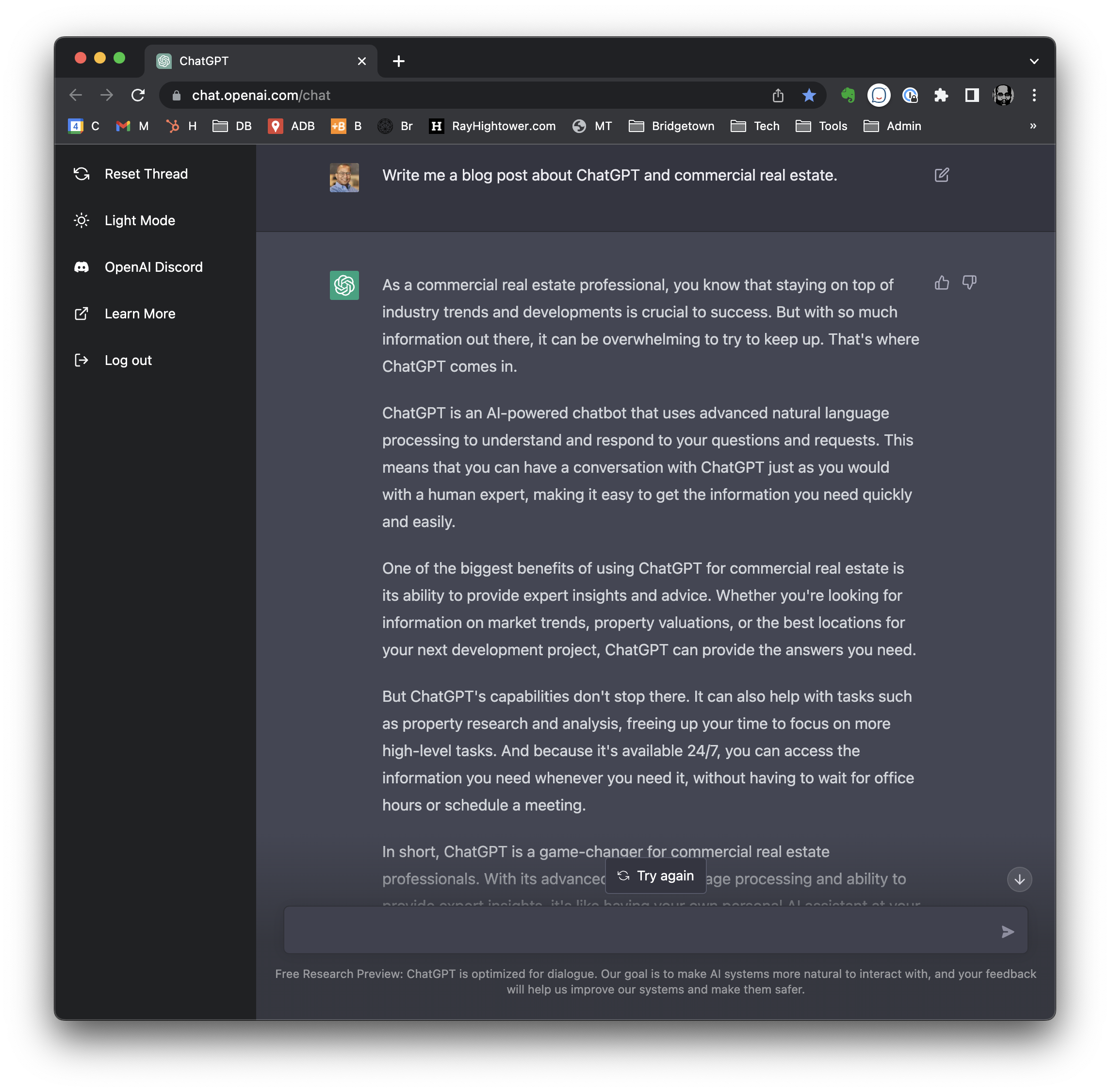

Artificial Intelligence wrote this blog post. Everything except this brief introduction.

An AI tool called ChatGPT (Generative Pre-trained Transformer) composed the post in response to this request from me:

Write a blog post on multifamily investments and bonus depreciation.

End of intro. The AI-generated article appears below. Click the image to enlarge.

Content from ChatGPT: Artificial Intelligence

If you’re a savvy real estate investor, you may be aware of the recent tax law that allows for bonus depreciation on certain types of real estate investments. This can be a great way to offset some of the costs of your investments and improve your bottom line. In this article, we’ll explore the world of multifamily real estate investments and how bonus depreciation can be a valuable tool in growing your wealth.

First, let’s talk about what multifamily properties are and why they can be a great investment. These properties consist of multiple units that are rented out to tenants, and they can generate a steady stream of income for their owners. Because of their potential for long-term wealth generation, multifamily properties are a popular choice among real estate investors.

Now, let’s talk about bonus depreciation. This is a tax law that allows investors to claim a higher depreciation deduction on certain types of property in the year it is purchased. This can be a huge benefit for real estate investors, as it can offset some of the costs of the investment and improve their bottom line.

So how can you take advantage of bonus depreciation on your multifamily investments? First, it’s important to understand which types of property qualify for bonus depreciation. Generally speaking, the property must be new or newly renovated, and it must be used for business purposes. This means that if you’re purchasing an older multifamily property and renovating it, you may be able to claim bonus depreciation on some of the renovations.

Once you’ve identified a property that qualifies for bonus depreciation, the next step is to work with your tax professional to determine how much of the cost you can claim. This will depend on a number of factors, including the type of property and the extent of the renovations.

In conclusion, multifamily real estate investments can be a great way to generate long-term wealth, and bonus depreciation can be a valuable tool in offsetting some of the costs of your investment. By working with a tax professional, you can determine how to take advantage of this tax law and maximize the benefits of your real estate investments.